What is Group Life Insurance?

Group Life Insurance is a type of life insurance in which a single contract covers an entire group of people, typically employees of a company or members of an organization. It provides beneficiaries with a lump-sum payment in the event of the insured individual's death or terminal illness.

Coverage Scope: Typically includes death benefits, and may also offer additional covers such as accidental death, dismemberment, and terminal illness benefits.

Simplified Process: Unlike individual life insurance, group life insurance offers a streamlined application process without the need for medical examinations, making it easier and faster to secure coverage for all members.

Benefits of Group Life Insurance:

Create your own employee benefit plan with customizable payment rates and amount of coverage per employee

Provide insurance coverage 24/7 on and off the job

Free Living Benefit Rider, which allows the terminally ill insured with a life expectancy of 12 months or less to withdraw up to 50% of the life insurance (maximum of P1 million)

Build your own benefits packages with additional features including accidental death and disablement, total and permanent disability income benefit and medical reimbursement

Employee’s option to convert group life coverage into an individual life insurance policy without evidence of insurability.

Why should your company/ organization consider Group Life insurance?

Financial Security for Families: Ensures that employees' families are financially protected in the event of unforeseen circumstances.

Attract and Retain Talent: Enhances benefits packages, making the company more attractive to current and prospective employees.

Cultural Alignment: Reflects the Filipino values of malasakit and family care, strengthening company culture.

Cost-Effectiveness for the Organization: Enables the company to significantly support their employees during critical times of illness or death without incurring overwhelming financial burdens, demonstrating fiscal responsibility alongside employee care.

Legacy Building: Contributes to building a legacy of care and responsibility towards employees' welfare.

Empowerment Through Choice: Offers employees peace of mind, knowing they and their families are protected, which can improve overall job satisfaction and productivity.

Innovation in Employee Benefits: Positions the company as a leader in employee welfare, setting a benchmark in the industry.

Benefits to the Organization:

Enhanced Company Reputation: Demonstrates a commitment to employee welfare, boosting the company's image as a caring employer.

Improved Employee Morale and Loyalty: Employees feel valued and secure, leading to increased loyalty and reduced turnover rates.

Attractive Recruitment Proposition: Makes the company more appealing to top talent, giving it a competitive edge in the job market.

Cost-Effectiveness in Supporting Employees: Group life insurance provides a financially viable way for the company to support

employees during critical times without significant financial strain, demonstrating a balance between employee care and fiscal responsibility.

Benefits to the Employee/Member:

Peace of Mind: Provides financial security and emotional peace of mind for employees and their families.

Simplified Access: Easy enrollment process without the need for medical exams.

Comprehensive Coverage: Access to benefits that might not be available or affordable on an individual basis.

Enhanced Well-being: Contributes to overall well-being by reducing stress related to financial uncertainties.

Risks of Not Having Group Life Insurance for your Organization:

Increased Financial Vulnerability for Employees and Their Families: Without group life insurance, employees' families may face financial

instability in the event of unforeseen circumstances, such as critical illnesses or the untimely death of the breadwinner.Challenge in Attracting and Retaining Talent: In a competitive job market, the absence of comprehensive benefits like group life

insurance can make it difficult for your company to attract and retain skilled professionals. Talented individuals often seek employers who demonstrate care for their well-being and security.Erosion of Company Culture: Failing to offer group life insurance may signal a lack of commitment to the core Filipino values of

malasakit and family. This can weaken your company's culture, affecting employee morale and their sense of belonging.Financial Strain on the Organization: Without a group life insurance plan, your company may find itself needing to provide ad hoc

financial support to employees and their families during critical times, which can be unpredictable and financially burdensome.Loss of Competitive Edge: Neglecting to provide essential benefits like group life insurance can position your company at a disadvantage, making it less appealing to both existing employees and prospective hires, compared to competitors who offer comprehensive benefits packages.

Compromised Legacy and Reputation: The absence of group life insurance might hinder your ability to build a legacy of care and responsibility, potentially affecting your company's reputation as an employer of choice and a leader in employee welfare.

Check out some of our Group Life Insurance Options

Click on the respective tabs to show the details of each option.

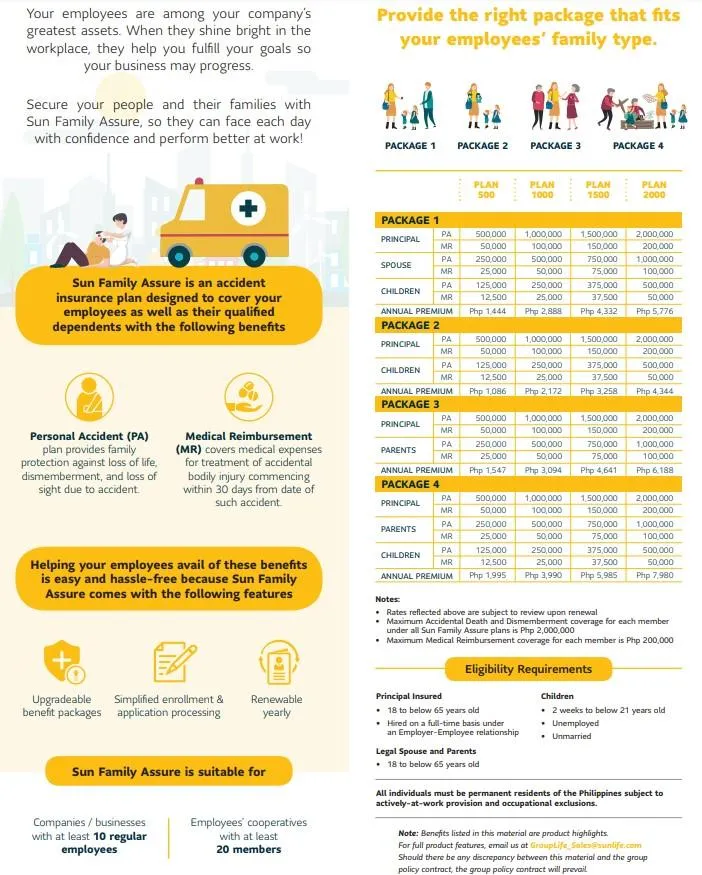

Sun Family Assure

5 Plus Group Life

Pro Student

Group Critical Illness Rider

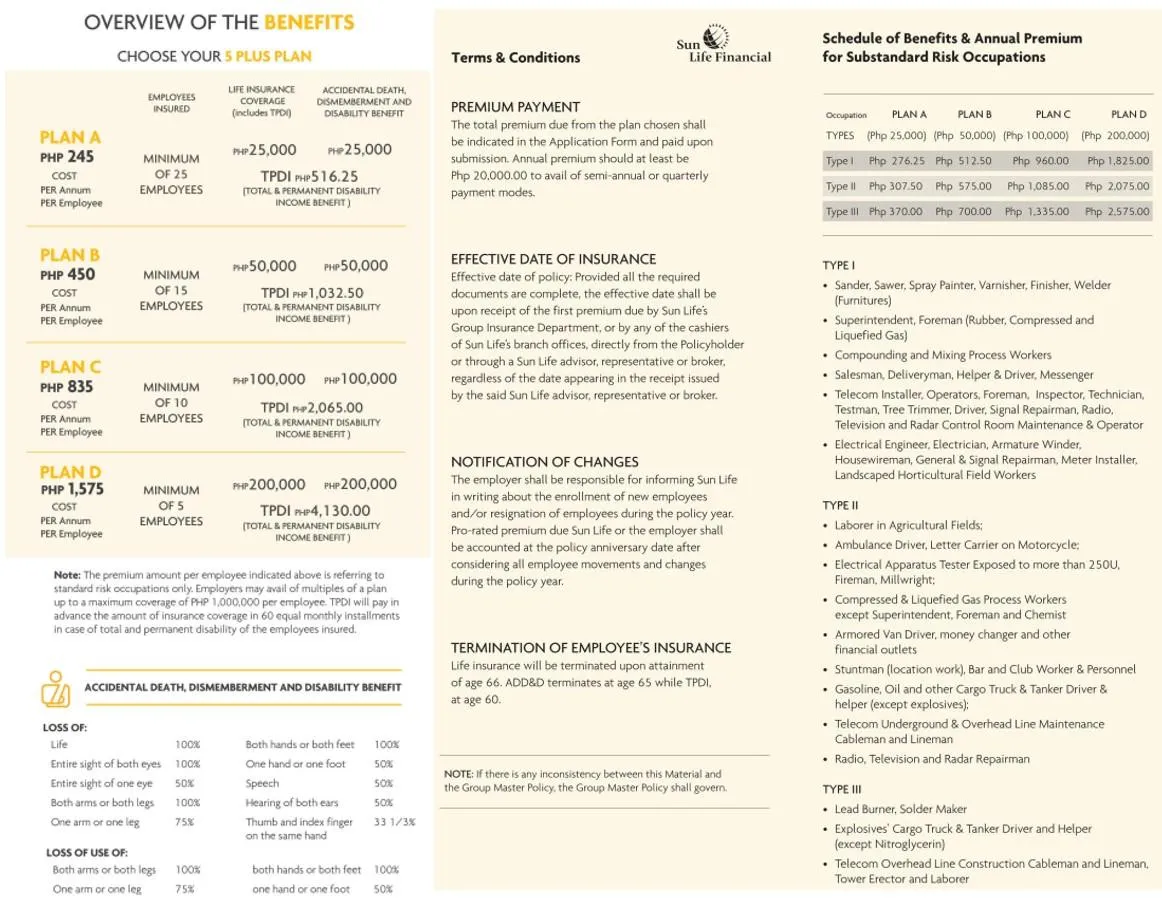

5 Plus Group Life

Secure your People. Build your Business

Coverage is renewable yearly.

Group Plan for SMEs

Low-cost insurance plans

Comprehensive coverage

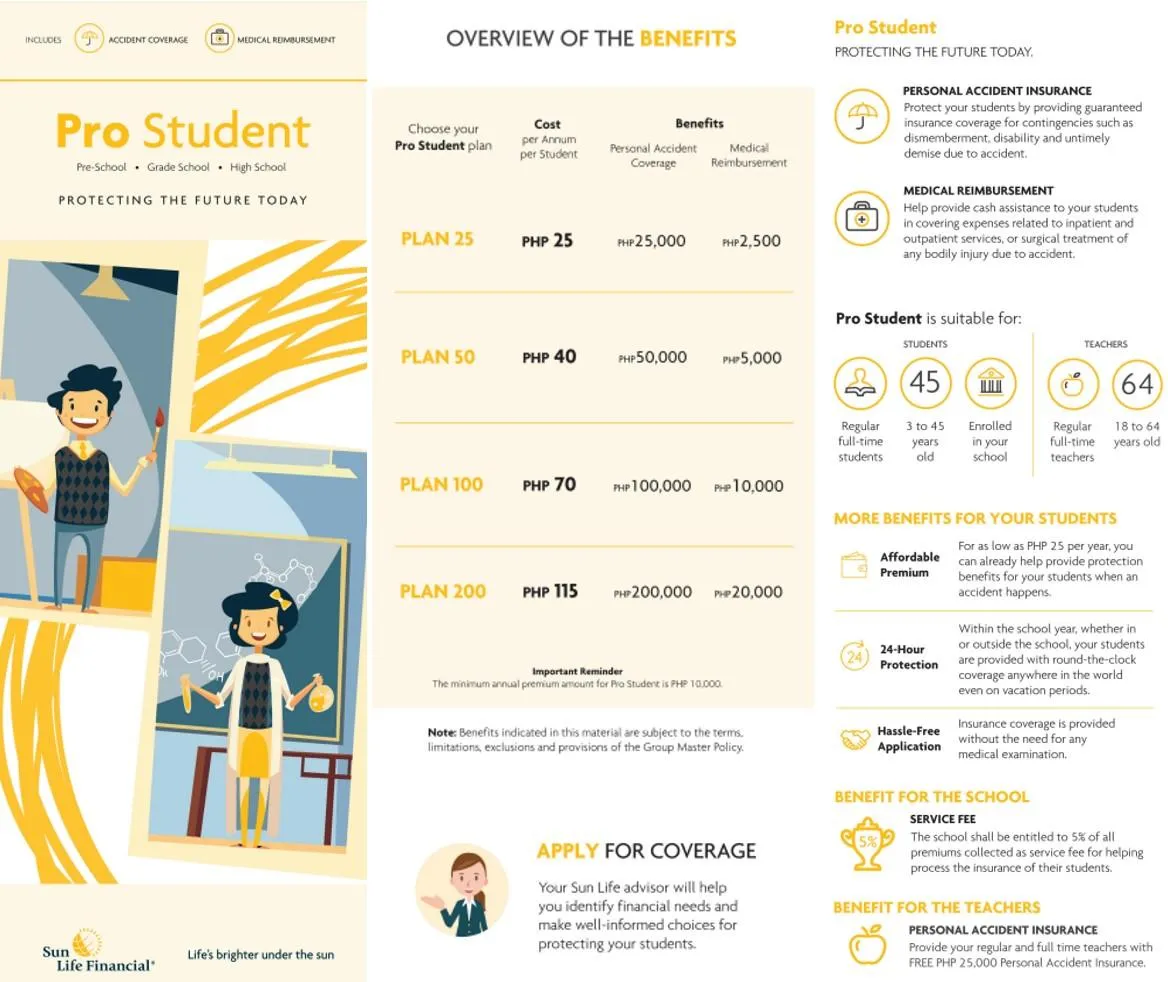

Pro Student

Protecting the Future Today

Coverage is renewable yearly.

Protection for students/ teachers

Insurance coverage 24/7

Medical reimbursement

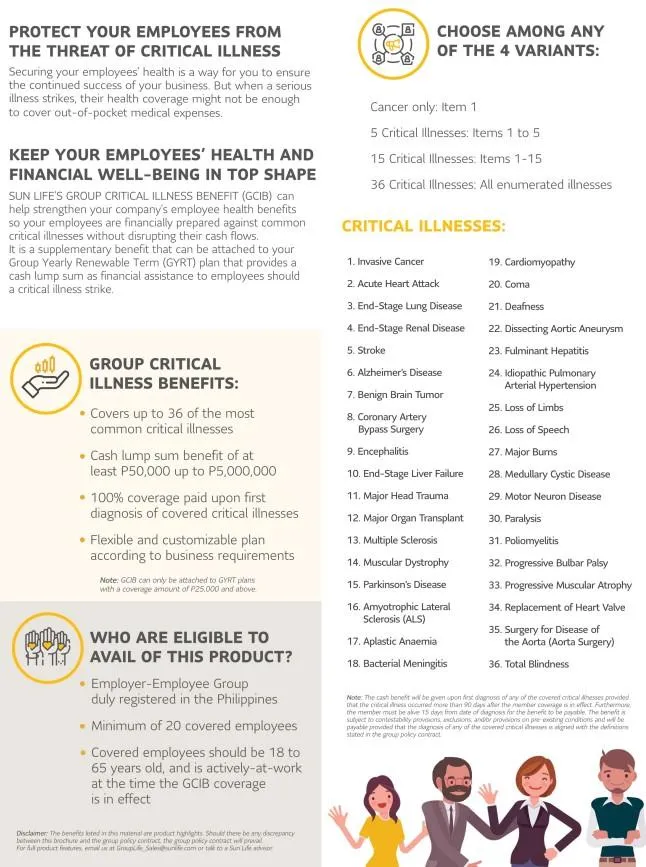

Group Critical Illness Rider

Protecting the Future Today

Coverage is renewable yearly.

Covers up to 36 critical illnesses

Customizable plan under Group Life Insurance

Cash lump sum benefit

Group Critical Illness Benefit (GCIB) is a supplementary benefit that provides a cash lump sum should a critical illness strike. Attach it to an existing Group Yearly Renewable Term (GYRT) plan to strengthen your company’s employee health benefits, so your employees can be financially prepared against common critical illnesses that could disrupt their personal cash flow.

Why Choose Sun Life?

Given the following Suggested Criteria in Choosing Group Life Insurance Provider:

Reputation and Stability: Assess the provider's track record and financial health.

Coverage Options: Look for flexibility and comprehensiveness in coverage.

Claims Process: Consider the ease and efficiency of the

claims process.Customer Support: Evaluate the quality of customer service and support.

Cost-Effectiveness: Compare pricing and the value of benefits offered.

Sunlife Group Insurance excels in all these areas, making it the preferred choice for organizations aiming to provide their employees with unparalleled financial security and peace of mind.

Why Sun Life?

Trusted Brand: Long-standing reputation and reliability in the insurance industry.

Comprehensive Coverage: Offers a range of customizable plans to suit different organizational and employee needs.

Exceptional Service: Dedicated support and seamless claims process for policyholders.

Flexibility: Plans can be tailored to include additional coverage, adapting to the unique needs of each organization.

Market Leadership: Pioneering insurance solutions with innovative products and services that set industry standards.

Brighter Service

Our partnership to ensure that your organization promotes a financially secure and healthier life for your employees or members goes beyond just basic life insurance.

RETIREMENT BENEFIT PLANNING - Subsidize the future retirement obligations of your company or organization with the help of our products.

INCENTIVE/ LOYAL REWARDS PROGRAM - Fund your loyalty reward schemes or employee performance incentives using the savings and investments features of our life insurance products.

KEYMAN INSURANCE - Protect your company's financial interest with life insurance products that cover the death of key persons.

HEALTH INSURANCE - Help your employees ease out-of-pocket expenses with hospitalization and critical illness insurance products.

FINANCIAL WELLNESS PROGRAM - Empower your workforce to achieve their lifetime financial goals with Sun Life's financial wellness program, specially designed and simplified for employees.

We are Sun Life Philippines

As a leading global financial services company based out of Canada, we offer a broad range of insurance, retirement and investment products and services to meet the diverse needs of both individual and corporate clients around the world.

Sun Life in the Philippines offers a diverse range of insurance, wealth, and asset management solutions to help every Filipino in their journey towards a brighter life.

As the country’s first and longest-standing life insurer, we provide:

Financial planning and guidance

Life insurance products for every life stage

Investment products for individuals, families, and companie

Health-focused products with an innovative wellness community

Exceptional client-servicing

Our roots trace back to Canada, where Sun Life was founded more than 150 years ago. Since then, we have expanded throughout the globe, guided by our focus on the humanitarian ideals and benefits of life insurance. With headquarters in Toronto, we operate in key markets worldwide including Canada, the United States, the United Kingdom, Ireland, China, Hong Kong, the Philippines, Japan, Korea, Indonesia, India, and Singapore. We take great pride in helping people around the world achieve lifetime financial security and lead healthier lives. Sun Life Financial Inc. trades on the Toronto (TSX), New York (NYSE), and Philippines (PSE) stock exchanges under the ticker symbol SLF.

For more information about Sun Life, you may visit our website at https://www.sunlife.com.ph/en/

Hi, I am Cyra Vallente

Your Trusted Group Life Advisor.

As a distinguished Financial Advisor with Sun Life of Canada (Philippines), Inc., I've dedicated my career to helping individuals, families, and business owners navigate the complexities of financial planning to achieve their dreams. My journey, rooted in over a decade of Human Resources experience in various local and global companies and magnified by my role at Sun Life, has been driven by a passion for understanding and addressing the unique needs of people from all walks of life.

Transparency, integrity, and trust form the foundation of my relationships with clients. I pride myself on providing objective advice, staying current with market trends, and adapting our strategies to the evolving financial landscape.

I would be glad to serve you and get people you care be protected while putting you in the best position to achieve your goals.

These awards and recognitions are testaments of Cyra's passion to serve others and being the best at what she does.

Million Dollar Round Table (MDRT) Member 2024

Multiple Top Advisor of the Month

Multi-Year Macaulay Club Elite Advisor

Advisor of the Year (2021)

3-time LIMRA International Quality Awardee

Medallion Awardee - Presidents Month 2022, 2023

Group life League of Champion - Summer Campaign 2021

Medallion Awardee - Summer and August Champs 2019-2022

Advisor Match Branch Representative (2021)

Certified Investment Solicitor 2020

Rookie Advisor of the Year 2019

Schedule your Free, Non-binding Group Life Inquiry Call

Use the calendar below and choose your best availability.

Frequently Asked Questions:

What is individual life insurance, and how does it differ from group life insurance?

Individual life insurance is a policy taken out by an individual to provide financial protection to their beneficiaries in case of their untimely death or terminal illness. Unlike group life insurance, which covers multiple individuals under a single policy and is often provided by employers, individual life insurance is customizable, offering tailored coverage to meet specific personal and family needs.

Who should consider getting individual life insurance?

Anyone looking to ensure their family's financial security and peace of mind should consider individual life insurance. It's particularly important for primary earners, parents, homeowners, business owners, and those with significant debts or financial obligations. It's also a valuable tool for anyone interested in wealth accumulation, estate planning, and leaving a legacy.

What are the main types of individual life insurance available?

The two main types are term life insurance, which provides coverage for a specific period, and permanent life insurance, which offers lifelong coverage and typically includes a cash value component. Within these categories, there are various policies tailored to different needs, including whole life, universal life, and variable life insurance.

Can I customize my individual life insurance policy?

Yes, one of the key advantages of individual life insurance is its flexibility. You can customize your policy by choosing the coverage amount, policy term (for term life), and adding riders such as critical illness, disability income, or accidental death benefits. This ensures the policy meets your unique financial and personal goals.

How do I choose the right amount of coverage?

The right amount of coverage depends on your financial goals, obligations, and the standard of living you wish to secure for your beneficiaries. Consider factors such as income replacement, debt repayment, future education costs for your children, and any other financial needs that would arise in your absence. A financial advisor can help you calculate an appropriate coverage amount based on these considerations.

How does the claims process work for individual life insurance?

In the event of a claim, the beneficiaries or the policyholder (in the case of a living benefit claim) must submit a claim form along with the required documentation, such as the death certificate for a death benefit claim, to the insurance company. The insurer will then review the claim and, if approved, disburse the benefit amount to the beneficiaries. The process is designed to be straightforward, and many insurers offer assistance to guide beneficiaries through the claims process.